rpgt on inherited property malaysia

Determination Of Chargeable Gain Allowable Loss. Disposal Date And Acquisition Date.

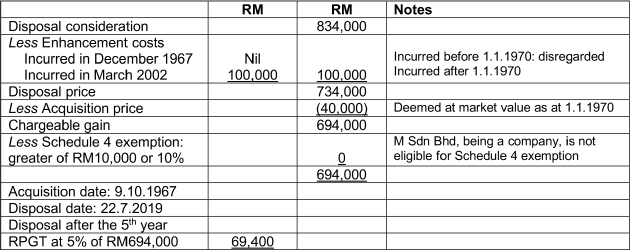

How To Calculate Rpgt In 2020 For Sale Of An Inherited Property

A copy of the Minutes of Board of Directors Meeting or a letter signed by a director confirming the management and control of the company are exercised in Malaysia.

. However a real property gains tax RPGT has been introduced in 2010. Real Property Gains Tax RPGT Rates. Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate.

Disposal Price And Acquisition Price. Disposal Date And Acquisition Date. A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia.

Real Property Gains Tax RPGT Rates. Government of Malaysia V MNMN. Disposal Price And Acquisition Price.

Real Property Gains Tax RPGT Rates. Form CKHT 2A - Acquisition of Real Property Shares in RPC. Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate.

Disposal Price And Acquisition Price. Disposal Date And Acquisition Date. Determination Of Chargeable Gain Allowable Loss.

Order 92 Rule 4 of the Rules of Court 2012. Malaysia used to have a capital gains tax on real estate but the tax was repealed in April 2007. Commencing from April 1 st 2021 IBRM payment counters in Kuala Lumpur Kuching and Kota Kinabalu will only accept payments of.

Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Real Property Gains Tax RPGT Rates. Real Property Gains Tax RPGT Rates.

It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy. Disposal Date And Acquisition Date. Disposal Date And Acquisition Date.

Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Part II Schedule 5 RPGT Act. Real Property Gains Tax RPGT Rates.

Company and Body of Persons. List of movement inout of Malaysia 2. Part 1 Schedule 5 RPGT Act.

For example individual Malaysian citizen and partners. Determination Of Chargeable Gain Allowable Loss. Real Property Gains Tax RPGT Rates.

Real Property Gains Tax RPGT Rates. RPGT is charged on chargeable gain from disposal of chargeable asset such as houses commercial buildings farms and vacant land. Explanatory notes for RPGT Form can be obtained at the official Portal of IRBM.

Real Property Gains Tax RPGT Rates. Method for submission of RPGT forms. Disposal Date And Acquisition Date.

Disposer is a company incorporated in Malaysia or a trustee of a trust or body of persons registered under any written law in Malaysia. Disposal Price And Acquisition Price. There is no capital gains tax for equities in Malaysia.

Disposal Price And Acquisition Price. Assessment Of Real Property Gain Tax. As of 2021 15 tax rate is applied for the disposal of securities and sale of property.

Real Property Gains Tax RPGT Rates. Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Disposal Price And Acquisition Price.

Disposal Price And Acquisition Price. Disposal Price And Acquisition Price. Real Property Gains Tax RPGT Rates.

Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Determination Of Chargeable Gain Allowable Loss. Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate.

Book debts benefits to. Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Transfer Of Asset Inherited From Deceased Estate.

Part III Schedule 5. Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology.

Disposal Price And Acquisition Price. Disposal Date And Acquisition Date. Disposal Date And Acquisition Date.

Real Property Gains Tax RPGT 3 of assets disposal value withheld by purchaser under section 21B of RPGT 1976 CKHT 502 Form Income tax paid by Foreign Artists Public Entertainer Withholding Tax. Purchase of basic supporting equipment for disabled self spouse child or parent. Disposal Price And Acquisition Price.

Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967. Article 41 and Article 1211 of the Federal Constitution of Malaysia 1957. RPGT Form is available at the nearest Inland Revenue Board of Malaysia IRBM branch or can be downloaded and printed at the official Portal of IRBM.

Disposal Date And Acquisition Date. Real Property Gains Tax RPGT 3 of assets disposal value withheld by purchaser under section 21B of RPGT 1976 CKHT 502 Form. Determination Of Chargeable Gain Allowable Loss.

Disposal Date And Acquisition Date. 603 8313 7848 603 8313 7849. Payment send by post has to be made using crossed chequebank draft and made payable to THE DIRECTOR GENERAL OF INLAND.

Determination Of Chargeable Gain Allowable Loss. Disposal Price And Acquisition Price. Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate.

The tax or additional tax payable is subject to an increase in tax under subsection 77B4 of ITA 1967. The amount of increase in tax charged for an Amended Return Form furnished within a period of 6 months after the date specified in subsection 771 of ITA 1967 shall be 10 of the amount of such tax payable or additional tax payable as shown in the following formula-. With effect from 21101988 RPGT is extended to gain from disposal of shares in real property company RPC ASSET includes any land situated in Malaysia and any interest option or other right in or over such land.

Disposal Date And Acquisition Date. Disposal Price And Acquisition Price. Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate.

Determination Of Chargeable Gain Allowable Loss. Determination Of Chargeable Gain Allowable Loss. Particulars of company Director Officer issued by Companies Commission of Malaysia CCM 3.

Determination Of Chargeable Gain Allowable Loss. Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Except part II and part III.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber. Real Property Gains Tax RPGT Rates. 603 8313 8888 Faks.

Disposal Date And Acquisition Date. Determination Of Chargeable Gain Allowable Loss. Responsibility Of Disposer And Acquirer.

Disposal Date And Acquisition Date. Real Property Gains Tax RPGT Rates. Instruments of transfer implementing a sale or gift of property including marketable securities meaning loan stocks and shares of public companies listed on the Bursa Malaysia Berhad shares of other companies and of non-tangible property eg.

Determination Of Chargeable Gain Allowable Loss. Disposal Date And Acquisition Date. Real Property Gains Tax RPGT Rates.

Property Inheritance In Malaysia Related Laws And Applications For Letters Of Administration Iproperty Com My

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

A Simple Guide To Inheriting Property In Malaysia

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

Tutorial 1 Scope Of Charge Docx Bbft2013 Taxation Tutorial 1 Scope Of Charge Question 1 A What Is Income Suggested Answer Income Is Not Defined Course Hero

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Part 1 Acca Global

Rpgt Increase In 2019 How Did Homeowners React Will It Impact The Property Market Iproperty Com My

How To Calculate Rpgt In 2020 For Sale Of An Inherited Property

Getting A Property Valuation On Your Inheritance When And Why

Selling Property And Real Property Gains Tax Planning Action Valuers

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia

Ensuring A Smooth Inheritance The Edge Property Malaysia

Financial Planning Financial Planning Simplified

Fundamental Of Estate Planning By Associate Professor Dr Gholamreza Zandi Ppt Download

Ensuring A Smooth Inheritance The Edge Property Malaysia

Rpgt On Inherited Property Malaysia

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

0 Response to "rpgt on inherited property malaysia"

Post a Comment